Opening Balance entries for the Payroll Liabilities can be entered at any time after your Go Live date.

![]() It would be in your best interest to complete these entries within the first month after your Go Live Date.

It would be in your best interest to complete these entries within the first month after your Go Live Date.

These entries will include, but are not limited to any Employee Payroll Deductions and Employer Payroll Liabilities.

These entries will be required to process the Liability Remittance Check(s) through your new software system.

Remember that the Payroll Liabilities Opening Balances are those values up to your Go Live Date. All Payroll Liability (Employee Deductions and Employer Liabilities) entries from your Go Live Date will automatically accumulate in the 2410 Payroll Liabilities general ledger account from your Payroll Entries.

For the Payroll Liability Opening Balances, the system does not separate the Employee Payroll Deductions from the Employer Payroll Liabilities. Therefore you will enter the Accumulated (Employee Payroll Deductions and Employer Payroll Liabilities) values as Payroll Liabilities Opening Balances.

1) Identify the Total Balance Values for the Payroll Liabilities.

a) Example - On December 31, 2010 the Payroll Liability values include;

| Employee | Employer | |

| Federal Withholding | $2,612.20 | $0.00 |

| FICA | $1,179.60 | $1,701.49 |

| EI/Insurance | $1614.48 | $0.00 |

| Province / State Withholding | $463.46 | $0.00 |

2) From the General Ledger Manager, select “GL Adjustments” at Top Left.

Figure 1

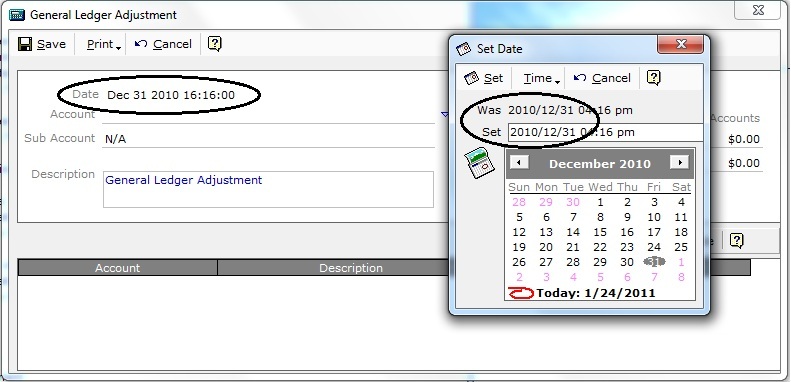

3) SET THE GL ADJUSTMENT - DATE TO THE DATE PRIOR TO YOUR GO LIVE DATE.

a) In this example the Go Live Date is Jan 1, 2011. We will use Dec. 31, 2010 as the date for the Opening Balance entries.

Figure 2

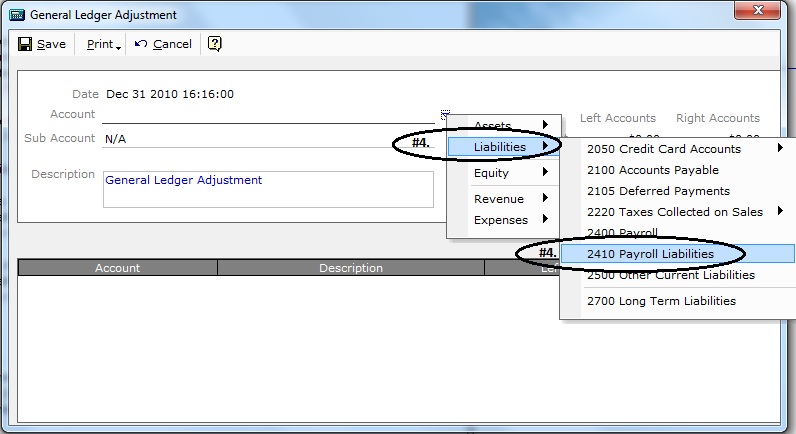

4) On the Account line, select Liabilities | 2410 Payroll Liabilities

Figure 3

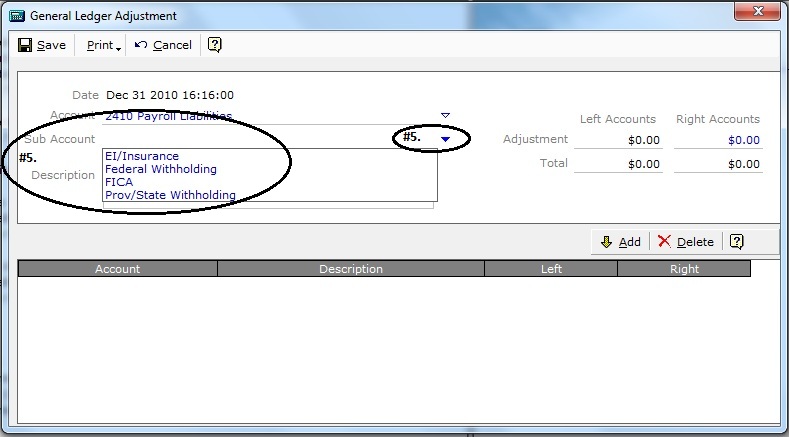

5) On the Sub-Account line, use the Smart Label to select the Sub-Account for the 2410 Payroll Liabilities.

Figure 4

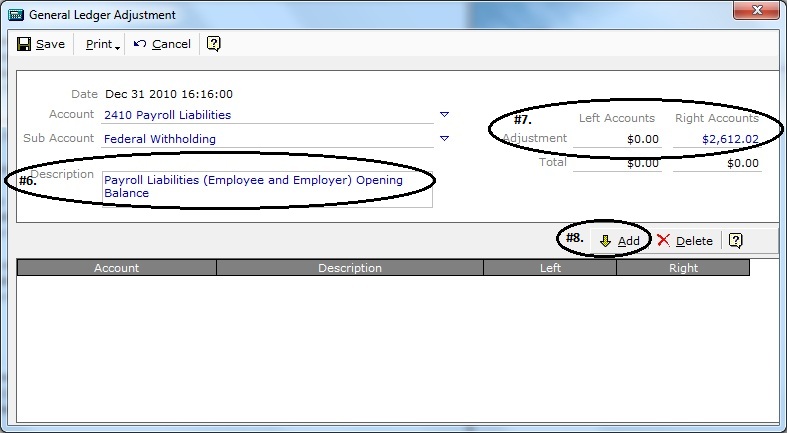

6) In the Description Box, enter a description for this GL Adjustment entry. The description is what will be referenced in the accounting reports (i.e. Audit Trail and Account Journals).

7) On the Adjustment – Right Accounts line enter the Opening Balance value for this account.

8) Select Add.

Figure 5

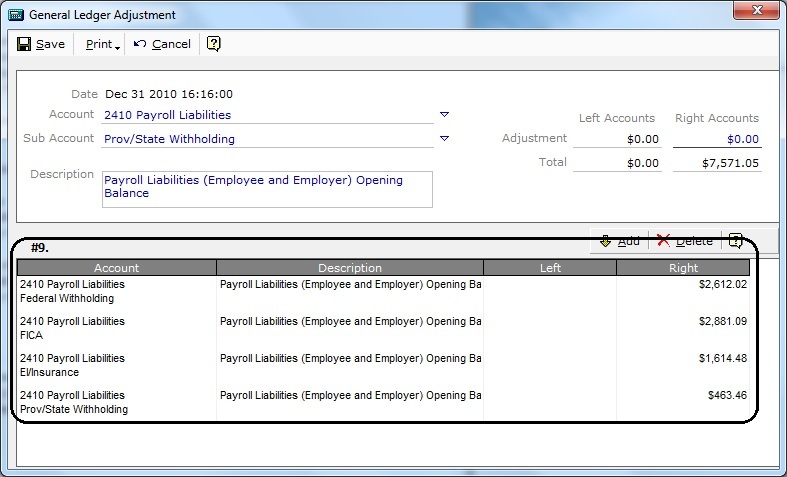

9) Continue to select and add Opening Balances for all Payroll Liabilities.

Figure 6

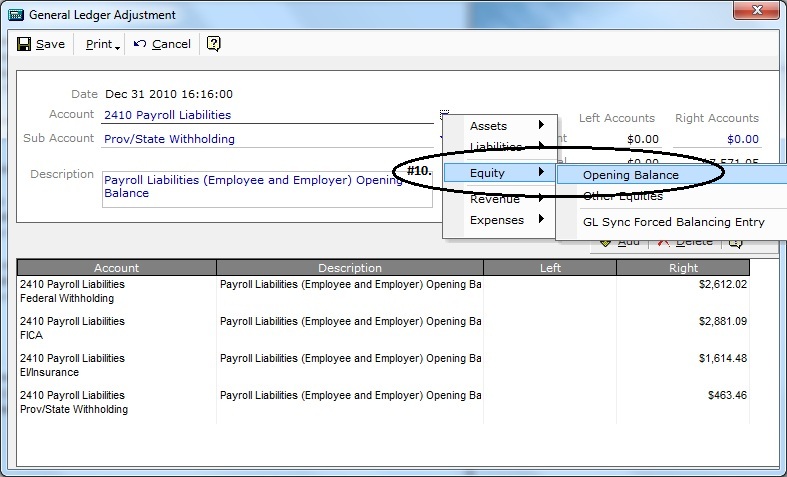

ALL OPENING BALANCE ENTRIES WILL REQUIRE AN OFFSETTING BALANCED ENTRY.

10) On the Account line, select Equity | Opening Balance.

Figure 7

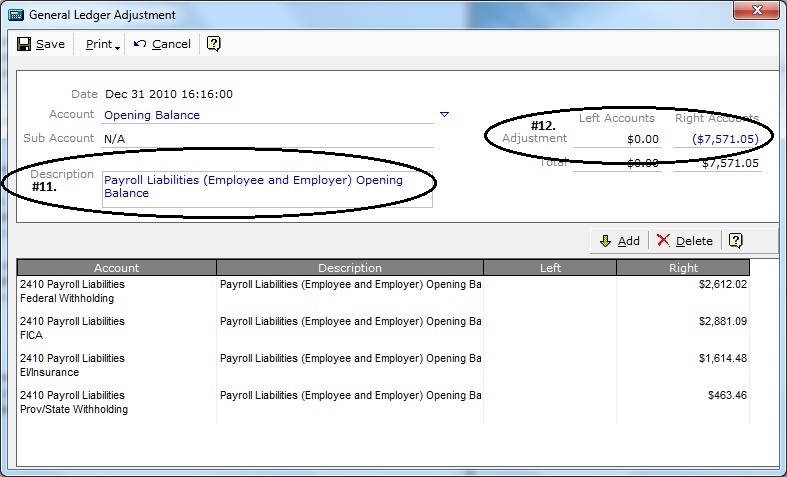

11) In the Description Box, enter a description for this GL Adjustment entry. The description is what will be referenced in the accounting reports (i.e. Audit Trail and Account Journals).

12) On the Adjustment – Right Accounts line, enter the value to Balance the Total line for the Left and Right Account lines.

a) Values can be positive or negative. For negative values enter a (-) either in front or behind the value.

13) Select Add.

Figure 8

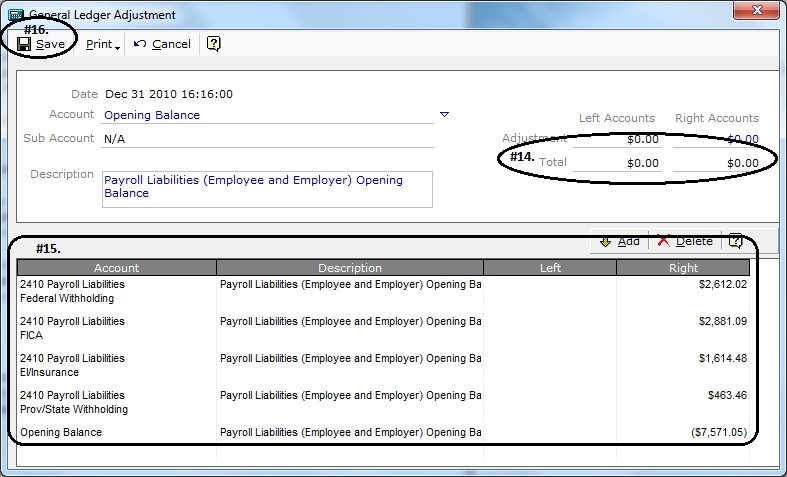

14) The Final Entry for the Opening Balances must ensure that the Total for the Left and Right Accounts lines balance.

15) Verify all entries.

16) Select Save at Top Left.