Negative Cash Paid

Out

Negative Cash Paid

OutUsing the cash drawer feature, you can perform typical daily procedures, including:

make a correction to a payment method

include transactions in a deposit

preparing a bank deposit

running reports

Watch the following video as a supplement to reading this article:

Transactions that appear in the Cash Drawer listing primarily consists of invoices and credits, but these transactions could also be from a variety of other sources, including:

Customer invoices

Customer deposits

Customer credit notes

Cash paid out

Payable payment and quick payment–if the method of payment is cash

Receivable payments and quick payments

Follow these steps to access the cash drawer feature:

Click the Banking button on the Home ribbon.

Click on the Cash Drawer item in the left window pane.

A listing of all unreconciled transactions will appear in the right pane.

From the cash drawer, you can make a correction to any transaction that has been processed with an incorrect payment method. Follow these steps:

Access the Cash Drawer according to the instructions given above.

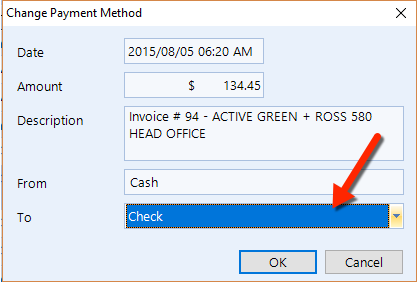

Click on a transaction for which you need to change the Payment Method, and then click the Change Method Payment method button in the ribbon to display the popup window.

Choose the correct payment method in the To drop-down, and then click the OK button to close the popup.

If necessary, click the Refresh button in the ribbon to see the new payment method appear in the listing.

Follow these steps to choose transactions that will be part of specific bank deposit:

Access the Cash Drawer according to the instructions given above.

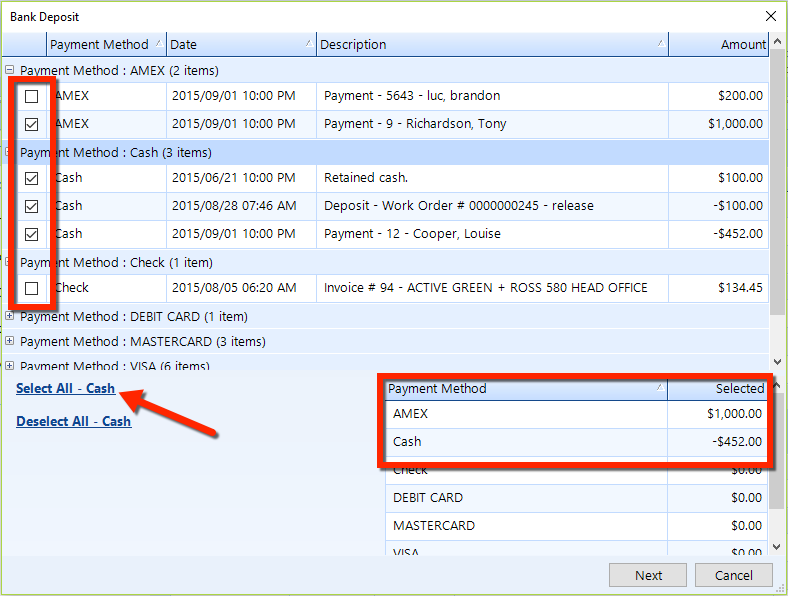

Click the Bank Deposit button in the ribbon to display a popup containing a listing of transaction groupings according to payment method.

Click the + button to expand any of the groups and view individual transactions.

Check the box for any transaction that you need to include in the deposit.

To include an entire group of transactions, click a group and the click the link in the lower left. In the figure below, the Cash group has been chosen and the Select All - Cash link is available to click. You can select multiple groups by repeating this step.

As you select each group or individual transaction, the totals in the lower right corner of the popup will increase to show the total value of the selected transactions for each group.

Click the Next button to continue.

Review the listing (similar to the figure below) to ensure that all transactions that have been chosen belong in this bank deposit.

Choose a Deposit Date that reflects the date on which this deposit will occur.

Choose the Bank Account into which the deposit will go.

If you keep cash/float on hand to make change, optionally enter the amount from this deposit that will be kept as Retained Cash. This should be the last step you do before making a deposit. If you perform an Out/Overage after you Retain, it will CLEAR it out.

Click on the Out/Overage button to enter an amount for any outage that you need to record. In the popup, choose a Payment Method, Adjustment Account, and enter an Amount of the outage/overage.

Click the Deposit button, and then click Yes if you want to print out a listing of the transactions for this deposit.

| NOTE: Typically, credit card payments will be received from cash as individual lines on the bank statement. As such, we recommend that deposits be performed by individual payment method–so that the bank account in Shop Manager reflects the exact amounts that will be seen on the bank statement. To ensure continuous accuracy, it may sometimes be necessary to record 3 or 4 individual deposits in Shop Manager on a particular day. |

To view deposit entries in a bank account, do the following:

Click the Banking button in the Home ribbon.

In the left window pane, click the bank account or credit card for which you want to see deposit entries. In the figure below, you can see entries for the Business Checking account.

Double-click on any deposit item to see the transactions that correspond to that specific deposit.

| NOTE: You can undo a Deposit if needed from a bank account. |

If you perform daily cash reconciliations, then you many want to produce daily reports.

These are the reports that you may find especially useful to run as part of a daily procedure:

Cash Receipts - displays a listing of all cash receipts in a specified date range

Invoice Summary - provides a listing of invoices and corresponding sales data

Vitals Signs by Service Category - view sales broken down to a level of detail below parts, labor, and sublet.

Tax - there are a number of reports in the Tax category of reports for viewing sales tax details.